All Categories

Featured

Table of Contents

"Understanding the Tax Repossession Process" offers a thorough summary of Tax Title Takings and Foreclosure treatments in material that went along with a 2005 seminar. Restricted Support Representation (LAR) is offered to any type of party who feels he or she can not manage or does not want an attorney for the whole case, but might utilize some assistance on a limited basis.

A capitalist that obtains a tax obligation lien certificate accumulates a lawful insurance claim versus the residential or commercial property for the amount paid. A tax obligation lien can be placed on a home since the owner hasn't paid home tax obligations.

The lien is eliminated when the proprietor pays the taxes yet the municipal or county authority will ultimately auction the lien off to a capitalist if they proceed to go unsettled. A certification is provided to the investor detailing the exceptional tax obligations and penalties on the residential or commercial property after they have actually positioned a winning quote.

Are Tax Liens A Good Investment

Not all states, areas, or districts offer tax liens. Some states such as California only hold tax obligation sales on defaulted properties, resulting in the winning prospective buyer coming to be the legal proprietor of the property concerned. The term of tax lien certifications typically varies from one to three years. The certificate allows the investor to collect the unsettled taxes plus the suitable prevailing interest rate throughout this time.

Tax lien certifications can be bid on and won based upon the highest possible cash amount, the most affordable rate of interest, or an additional method - tax liens investments. The sale of a tax lien certificate starts when the city government sends out tax obligation expenses to residential property owners for the amount owed on their residential or commercial property taxes. The regional federal government places a tax obligation lien on the property if the homeowner stops working to pay the taxes in a timely manner

Bidders generally have to sign up and provide a down payment prior to getting involved. Capitalists bid on the tax lien certificates at the auction by using to pay the unsettled tax obligations plus any passion and charges. The winning prospective buyer receives a certification that represents a lien on the building for the amount they paid.

The capitalist is generally able to confiscate on the property and take ownership if the owner fails to retrieve the certification. A residential property must be taken into consideration tax-defaulted for a minimum duration that depends on neighborhood law prior to it's subject to the lien and public auction process.

An investor might potentially acquire the residential property for dimes on the buck if the homeowner falls short to pay the back taxes. Acquiring a home in this manner is a rare event, nonetheless, due to the fact that most tax obligation liens are retrieved well before the home mosts likely to repossession. The price of return on tax lien certifications isn't guaranteed and can differ relying on whether the homeowner retrieves the certification and whether the capitalist can seize on the home.

Adverse facets of tax obligation lien certifications consist of the demand that the capitalist pay the tax obligation lien certification amount in full within a very short period, generally one to three days. These certificates are additionally very illiquid because there's no second trading market for them. Those that buy tax lien certifications must likewise undertake significant due persistance and study to ensure that the underlying residential or commercial properties have actually a suitable evaluated worth.

Tax Lien Investing Reddit

There might be tax obligations enforced at the government, state, or local degrees relying on the situations of the certificate. The revenue made may undergo taxes if a financier gains passion on a tax lien certificate. Rate of interest revenue is normally reported on the investor's tax return in the year it's gained.

The capitalist will certainly receive the amount paid for the certificate plus the passion gained if the homeowner retrieves the tax obligation lien certification by paying the unsettled taxes and any kind of interest or charges owed - tax lien investing north carolina. This quantity is considered a return of major and it isn't gross income. The capitalist can acquire the building via foreclosure if the homeowner is incapable to retrieve the tax lien certificate.

Any income or gains gained from the sale or leasing of the building will also be exhausted, just as with any other building. Some states and regions may likewise impose tax obligations or costs on tax lien certification investments. A tax lien and a home mortgage lien are both lawful cases against a building however they're dramatically various in a few means.

Residential property proprietors can retrieve a tax obligation lien by paying the unpaid taxes plus any kind of interest or fees owed. Home mortgage liens can normally only be satisfied by settling the whole underlying financing. Both liens are similar because they stand for financial obligation that might be paid off yet the hidden nature of that debt is different.

A city government entity might desire to offer the lien to an investor with a tax obligation lien certificate sale afterwards time has actually passed. Home mortgage liens can last throughout of the home loan which may be considerably much longer. Home tax obligation lien investing may be a possible financial investment for those who desire to hold alternate financial investments and desire exposure to genuine estate.

What Is Tax Lien Certificate Investing

It's generally suggested that you understand tax lien investing, recognize the regional real estate market, and do research study on buildings before spending. There are numerous drawbacks to tax lien investing.

Having a tax lien versus you does not always harm your debt because the 3 major credit report bureaus do not include tax obligation liens on their consumer credit scores records. But real estate tax liens might refer public document and the details that you owe an outstanding tax obligation bill would certainly be commonly available to the public.

A local government produces a lien versus the home and can auction off the civil liberties to that lien in the form of a certification if the tax obligations remain to go unpaid. A capitalist who purchases the tax obligation lien certification may have the ability to recover their principal while also earning some interest using charge fees ought to the initial residential property owner be able to pay off the tax lien in the future.

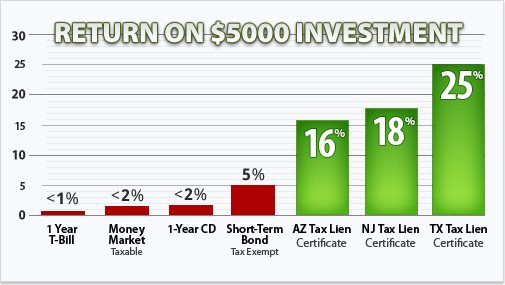

The secret to is to allow your money to benefit you. Tax liens are an efficient way to do this. In Arizona, a person may buy tax obligation liens and gain up to 16% on their financial investment if they are retrieved. If they are not redeemed, the investor might confiscate upon the home after 3 (and as much as ten years). The procedure is reasonably straightforward.

Table of Contents

Latest Posts

Excess Funds

Delinquent Tax Auction

Investing In Tax Liens Certificates

More

Latest Posts

Excess Funds

Delinquent Tax Auction

Investing In Tax Liens Certificates